In America and Canada, dental insurance coverage is quite pervasive. In fact, about 80% of Americans have either private insurance (172 million) or enjoy publicly funded dental benefits (87.6 million).

But how many people actually understand how insurance works? Have you ever asked yourself “what is covered by my dental insurance?” Are you taking full advantage of your benefits to keep your pearly whites healthy? Read on to learn about how dental benefits work and what dental procedures are covered by insurance.

How does dental insurance usually work?

When you sign up for dental insurance, you’ll pay a monthly premium, just like health insurance. Many plans also use a co-insurance structure. This means the insurance company will pay part of the cost of the procedure and you’ll be responsible for the remaining amount.

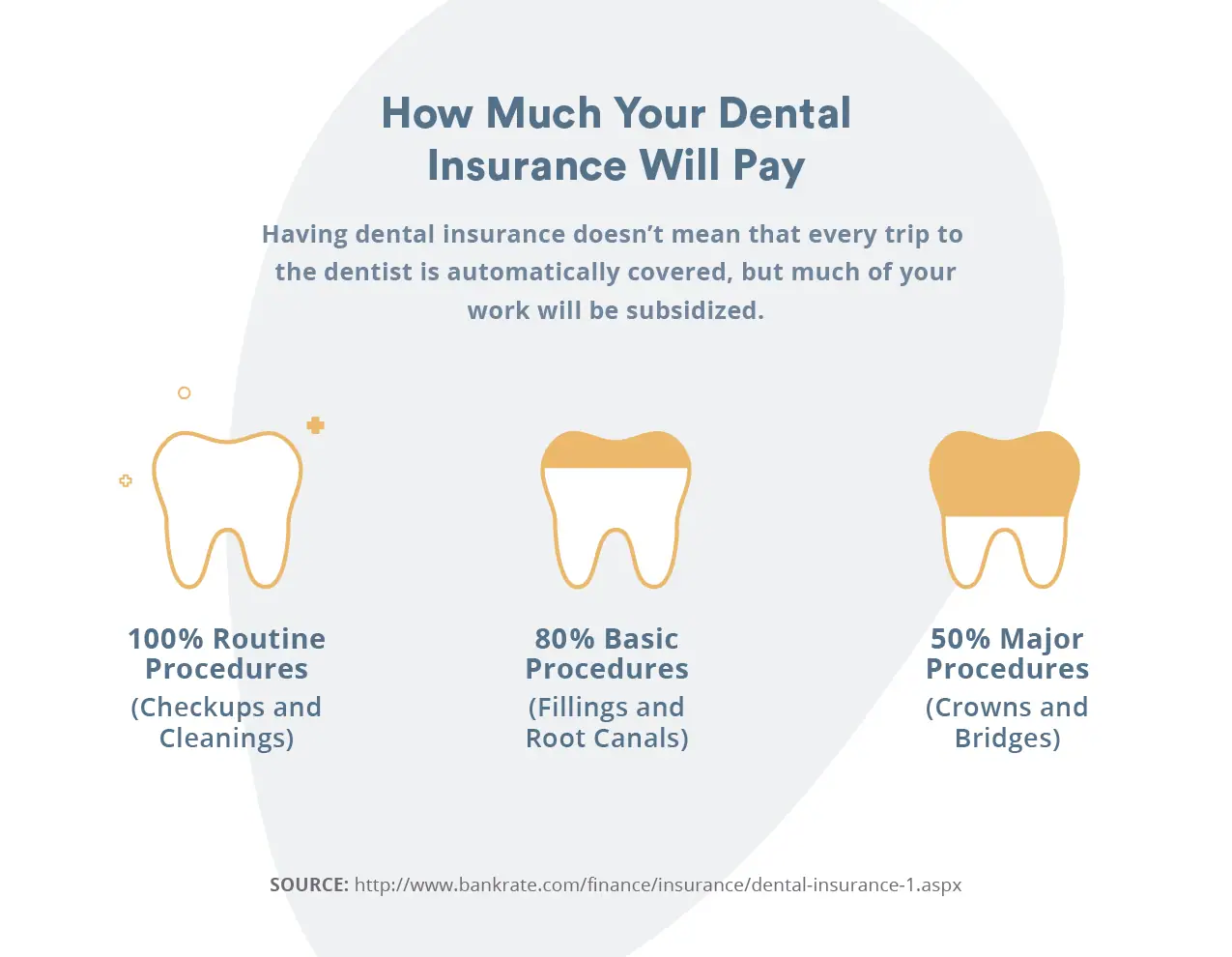

For example, PPO plans (we’ll explain more about this common type of dental plan later), use a 100/80/50 co-insurance structure. This means they’ll pay 100% of preventative care costs, 80% of the cost of basic procedures (such as a dental filling), and 50% of major procedures.

We reward you for going to your dental checkup!

Many plans will have a deductible, which means you’ll have to pay for a certain amount before your insurance kicks in. Annual maximums are also common, which means they will only pay up to a certain amount within a one-year period.

You can buy stand-alone dental insurance. However, many people have dental benefits attached to their medical insurance. A stand-alone plan tends to be more flexible and offers more benefits overall. They also are not likely to have a waiting period which means you can get the care you need faster.

Dental benefits as part of your medical plan are more convenient. However, there are typically more limitations on the benefits such as when and how they can be used.

Basic dental plans vs full coverage plans

Before deciding on a plan, it’s important to be aware of what it covers. Dental insurance plans can be divided into two groups – basic and full coverage.

Basic dental plans cover preventative care costs. This includes coverage for routine dental visits, professional cleanings, and dental x-rays. Some plans will also offer partial coverage for basic procedures like fillings. However, your insurance co-pay will generally be higher.

Full-coverage plans generally cover the same things as basic plans. You can expect preventative care coverage and basic procedures. However, they offer coverage for a wider range of procedures, as well as the percentage that is covered is higher.

With a full-coverage plan, procedures like crowns, root canals, and extractions may be covered. Plus, more advanced procedures like dentures, dental implants, braces, Invisalign, and other orthodontic procedures may also be included.

The name full-coverage is slightly misleading because they still won’t cover 100% of your dental costs. Plus, each plan has its own list of covered treatments. Be sure to read the fine print carefully before undergoing dental treatment.

Types of coverage:

Now let’s talk about the various places you can get your insurance coverage.

Employer coverage

Most people with private insurance get it through their employer or some other kind of a group insurance plan. This is typically a less expensive way to get coverage, but not always so do your homework. It depends on the type of plan your employer offers.

Large employers are more likely to offer dental benefits, but some smaller companies also offer coverage.

Individual plans

If you don’t have access to dental coverage through your employer, you can get an individual or family plan. Most preventative care costs will be 100% covered, however always read carefully to understand your whole coverage package.

Medicare

The government program for patients 65 and over doesn’t cover most dental care. There is one exception, however. Medicare Part A, which is hospital insurance, will cover certain dental services if the patient receives them while they are in the hospital.

VA benefits

Eligible individuals can buy discounted dental insurance through the VA. Coverage is offered through Delta Dental and MetLife. The patient is responsible for paying premiums as well as the full cost of copays.

Medicaid

Medicaid is another publicly-funded source of dental benefits used for people who can’t afford dental care. Eligibility is based on income and coverage tends to be very limited.

All states are required to offer dental benefits to children, but each state can decide what they want to offer for adults. Most states offer at least emergency dental care coverage but fewer than half of the states offer comprehensive dental coverage for adults.

What procedures are typically covered?

Are dental cleanings covered by insurance? Preventative care is typically cheaper than dealing with the ravages of periodontal disease or other dental issues. To that end, most dental plans offer coverage for the following:

- Twice-yearly dental exams (may require a co-pay)

- Dental x-rays, commonly offered once every two years

- Dental fillings

- Root canals

- Tooth extractions

- Bridges, crowns, implants

- Emergency dental care

- Dental appliances

Keep in mind not all of these procedures are covered fully. Dental procedures are divided into four categories, preventative, diagnostic, major, and basic.

Preventative and diagnostic procedures are often covered at 100%. This includes regular dental exams, professional cleanings, and dental x-rays.

Basic procedures are covered at 80% and major procedures at 50%. Major procedures include crowns, bridges, dentures, and other similar procedures.

Basic procedures include fillings, root canals, oral surgery, and periodontal care. All of these except fillings can be considered major procedures as well. It depends on the severity of your situation.

Dental bonding is also typically covered. However, if the tooth needs bonding as a result of an accident, you’ll be encouraged to use your medical insurance first.

What procedures typically aren’t covered?

There is also a list of dental procedures that insurance typically doesn’t cover. Much of the determination is based on medical necessity.

For example, you may need a crown to hold together a broken tooth and help to prevent further damage and that would be covered. However, a veneer over a chipped tooth serves a primarily cosmetic purpose. For this reason, veneers are almost never covered.

Another good example is that dental plans will cover silver-colored amalgam fillings based on medical need. However, if you want more expensive tooth-colored composite fillings, you’re going to have to pay the extra cost for those.

Due for a checkup?

Find a top rated dentist near you that takes your insurance.

Nitrous oxide (laughing gas) is used sometimes to help nervous patients relax. Unfortunately, dental insurance doesn’t cover it. If you really can’t handle visiting the dentist, you can opt for sedation which is usually covered.

However, this won’t usually apply to regular checkups. Most insurances will add the caveat that you need to be having two extractions or some other type of major work for sedation to be covered. Alternatively, your dentist can write a prescription for something to calm your anxiety and insurance will typically cover that.

Dental appliances such as mouthguards for bruxism (teeth grinding) are usually not covered. In some situations, such as for gum surgery, some insurances may cover mouthguards.

How much does dental insurance cost?

Dental insurance is relatively affordable, on average costing Americans between $15 and $50 a month. To determine if dental insurance is worth it for you, you’ll need to pay attention to your dental habits as well as the type of plan you purchase.

Don’t forget to factor in other dental costs like co-pays, co-insurance, deductibles, and annual maximums.

You also need to carefully weigh your likelihood of needing major dental work done as the cost can quickly add up. For people with healthy teeth, it can be cheaper to pay for the cost of routine dental care out of pocket.

Types of dental insurance networks

Insurance providers typically work with a network of dental professionals. To get the most benefit from your plan, you’ll want to choose in-network providers. Let’s look at the most common types of dental networks you might encounter.

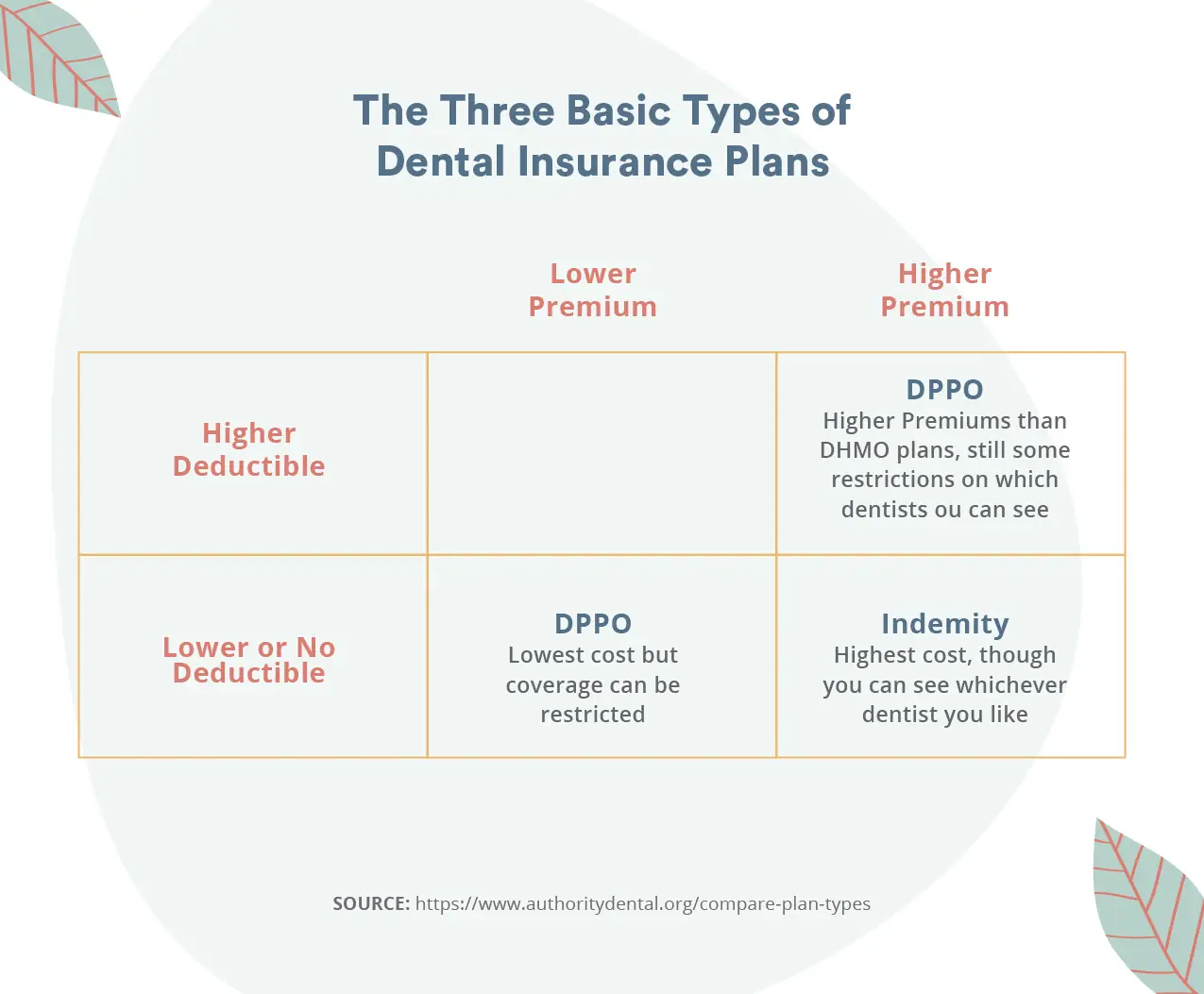

PPO

A preferred provider organization (PPO) has a list of preferred dentists in their network. You’re not completely restricted to using a dentist from their list, so if you find a dentist outside their network that you like, you can go to them, but you’ll pay more to do so.

DHMO

A dental health maintenance organization (DHMO) is similar to PPOs in that they provide a list of preferred dentists. This arrangement takes all the guesswork out of knowing how much your dentist appointment will cost. All the dentists in the network have agreed to a set price for their services.

There is no annual maximum or deductible, but you are required to use in-network providers.

Fee-for-service dental plans

These types of dental plans offer the most flexibility with a very large network of providers. However, the price you pay for services can vary significantly. You are required to pay a percentage (which varies according to procedure) and your insurance covers the rest.

Choosing your dental insurance plan

We hope this article has given you some guidance when it comes to dental insurance and dental procedures covered by medical insurance. The most important thing is to stay up-to-date with your dental checkups. Regular exams and cleanings are the best way to avoid expensive dental problems in the first place.

Find a dentist near you and level up your oral wellness today!