by Stephanie O’Mahoney, Portfolio Manager, Wealthsimple

It’s no secret that stress takes a serious toll on our health (especially for women), but the number one cause of stress for men and women is money. As a financial advisor at Wealthsimple, I speak to people every day that communicate their stress over money – from feeling like you aren’t earning enough, or spending too much, or planning for far away goals like retirement. It’s very normal to have tumultuous, confusing, and negative emotions related to money.

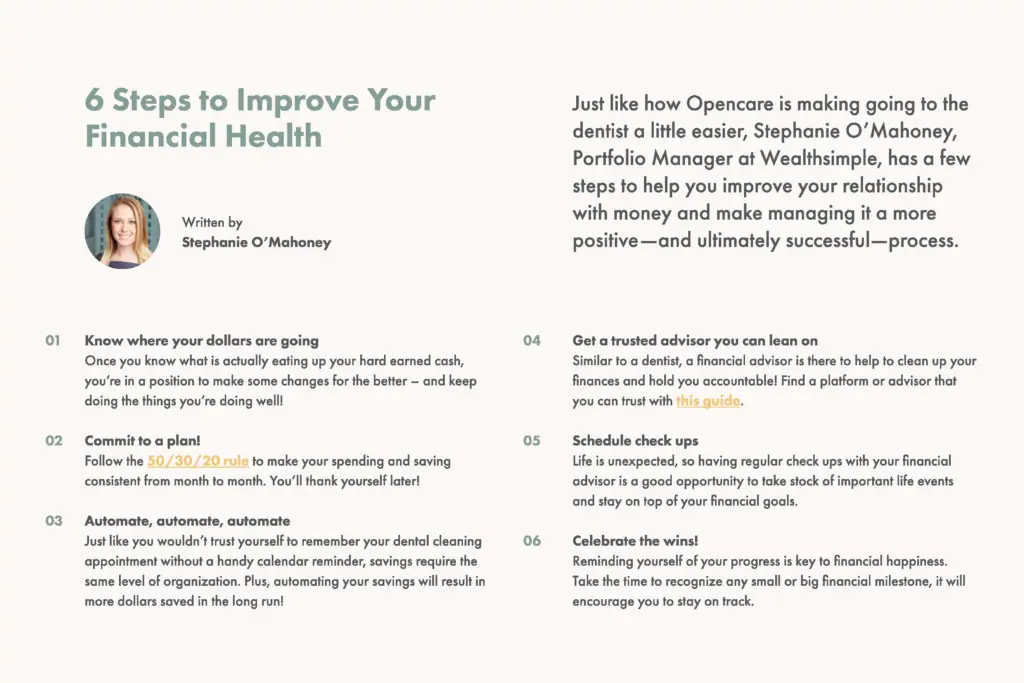

And we tend to avoid tough topics, like money stress, for fear of making it worse. But just like how Opencare is making going to the dentist a little easier, we have a few steps you can take to help improve your relationship with money and make managing it a more positive—and ultimately successful—process.

1. Know where your dollars are going.

Something I hear often from clients is that they are too nervous to dig deep into where their hard earned dollars are actually going. Did I really spend that much on dinners out? Did I actually take that many Ubers? Knowing where your money is going is the first step in tackling your financial stress. Luckily, there are a lot of tools that make keeping track really easy.

Most financial institutions have finance trackers that account for your dollars, plus there’s a lot of free and useful apps that will track your spending automatically. Take some time to be honest with yourself about what is a need versus what is a want and be thoughtful about where you might be able to cut down.

This is also a good opportunity to review the “extras” you might get through your job but are also paying into – things like health care coverage and retirement plans are the big ones. If you know what you’re entitled to through these plans then you can budget accordingly. For example, if you know you have 80% dental coverage, you’ll want to make sure you have enough cash for the other 20% of your dental bills.

For couples or families, it’s also wise to compare benefits and make sure that you’re maximizing the plan that is most beneficial for your family. If you and your partner both have coverage through your companies’ insurance plans, sit down together and review which plan provides the best spousal coverage (remember, spouse can include common law!) You can opt out of whichever plan you don’t use, save on the paycheque deduction, and put it towards your savings!

Just like going to the dentist, checking in with our finances is always a little worse in our minds than in reality. Once you know what is actually eating up your hard earned cash, you’re in a position to make some changes for the better – and keep doing the things you’re doing well!

2. Commit to a plan for the money you have coming in.

I find the term “budget” can often sound restrictive and daunting, so instead I want you to think about a few basic money rules as the key to your financial freedom. If you can make enough room for the things you need to tackle financially, then you have the freedom to enjoy your extra cash. Elizabeth Warren popularized the 50/30/20 rule which is a really simple place to start. 50% of your take home pay, meaning the cash that hits your bank account, goes towards needs – this includes things like rent, groceries, bills, healthcare expenses, minimum debt payments and other monthly obligations.

Where possible, only commit to needs that will keep you within 50% of your take home pay. Sometimes this can mean revisiting your living situation or the car you drive – freeing up cash here can make all the difference! The 20% goes towards saving for your longer term goals, and additional debt repayments.

When repaying debt, it’s important to start with the highest interest rate debt first. This 20% is the portion you’re allocating for future you, and I promise future you will thank you later! Finally, the 30% left over is all for you. This is your chance to indulge without going over the top – that fall coat you’ve had your eye on, a dinner out with friends, or a trip (hopefully one day soon!)

One of the most frequent questions I get from clients who have mastered these steps so far is “Okay, I have savings, what now?” Wealthsimple put together this quick and easy video to help you figure out where to direct your savings to make sure you’re making your money go further.

3. Automate as much as you can!

Just like you wouldn’t trust yourself to remember your dental cleaning or doctors appointments without handy calendar reminders, you should do the same with your savings. Studies have shown that automating your savings will result in more dollars saved in the long run.

Most banks and investment companies (like Wealthsimple) will allow you to set up automated deposits or payments in a frequency that works best for you. Do you get paid on the 15th of every month and want the money to go towards your savings before you’re tempted to spend it? Perfect, set your auto deposit for that day. Or perhaps you prefer a larger amount to come out once a month. Whatever the case may be, find a frequency that works for you. If you work freelance or have inconsistent pay that makes this challenging, you can set a reminder every few months to make sure you’re still hitting your savings goals when you do have money coming in.

4. Have a coach or a trusted resource you lean on.

There’s a reason pro athletes and CEOs still have coaches, and it’s because we do well when there is someone to help guide us and hold us accountable. When you’re working out with a trainer, you know you’re doing those extra squats. When your dentist appointment is coming up, you become more diligent about flossing daily. Platforms like Opencare help you find dentists that fit what you need – and you should do the same with your finances.

Search around and speak to as many different professionals as you can until you find a platform or person that you can trust. This article breaks down how you can choose a financial advisor. It’s important to keep in mind that spending more in this case does not mean getting better results. Keeping your financial advisor costs low is a crucial financial strategy that will help ensure more of your cash ends up in your pocket.

5. Schedule check ups.

We know we should go to the dentist every 6 months, and the doctor at least once a year. So to keep your finances healthy, schedule check ups for yourself. Life is unexpected and circumstances change, so having regular check ups with your financial advisor is a good opportunity to take stock of major life events and how they might play into your finances. If you’ve gotten married or had children, you should be sure to create or update your Will, or open a Registered Education Savings Plan to save for your child’s education after high school. Doing a quick pulse check will make sure you stay on top of your financial goals. It’s a lot easier to keep up than it is to catch up!

6. Celebrate the wins!

Rest assured, you’re not alone in thinking that you haven’t saved “enough” or are doing the “right” things with your money. Different points in our life will bring with it different stress around money, and sometimes we might never feel as accomplished as we’d like (I’ll feel good when my debt is paid off, I’ll be happy when I have $10,000 saved, etc.) This makes it even more important to pat yourself on the back every time you reach an important milestone. Have you crushed your student debt? Amazing! Reached a big savings threshold? Woohoo! Reminding yourself of your progress is key to financial happiness – if you take time to recognize how far you’ve come, it will encourage you to stay on track.

In just a few small steps you can be well on your way to tackling the financial stress that comes along with adulting – and as always, if you need back up just reach out to us at Wealthsimple. We’re here to help.

Wealthsimple helps people like you take care of your future selves. With a combination of powerful technology and human help, you can start saving and investing in under 5 minutes. As an Opencare user, get $50 when you open a new Wealthsimple account and fund it with $500 or more. Sign up now to take advantage of this special offer!